The ROI of a New Commercial Roof: How It Increases Property Value, Lowers Costs, and Boosts Resale

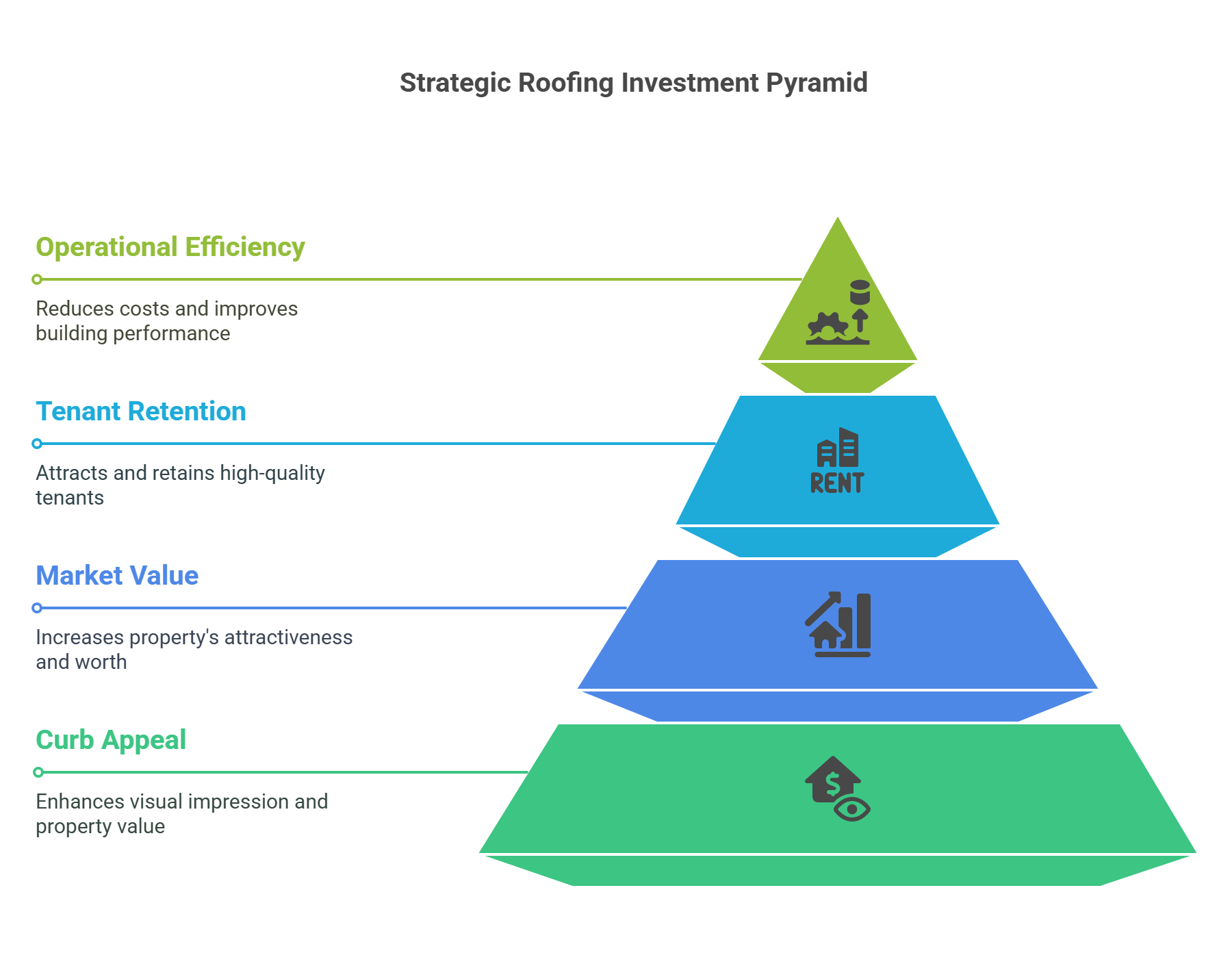

For most commercial property owners, roofing is seen as a necessary expense—an unavoidable line item for maintaining structural integrity. But what if a new roof could be more than just a fix? What if it could act as a strategic investment, directly enhancing your building’s market value, tenant retention, and operational efficiency?

In today’s real estate landscape, capital improvements like roofing upgrades aren’t just maintenance—they’re leverage. Modern materials, energy-efficient systems, and transferable warranties can influence everything from insurance premiums to net operating income (NOI) and appraisal outcomes. Whether you’re planning to sell, refinance, or attract high-quality tenants, your roof might be one of the most overlooked ROI levers at your disposal.

This guide breaks down exactly how a new roof increases commercial property value—financially, functionally, and strategically. We’ll cover the real impact on curb appeal, appraisal math, insurance positioning, tenant experience, and resale potential, using data-backed insights and real-world examples.

Curb Appeal & First Impressions

When prospective tenants, investors, or buyers evaluate a commercial building, their judgment begins the moment they see the structure—often before stepping out of the car. A roof in poor condition sends an immediate signal: deferred maintenance, potential hidden costs, and operational neglect. On the other hand, a well-maintained or newly installed roof conveys professionalism, care, and long-term investment in the property.

Curb appeal isn’t just an aesthetic concern—it’s a valuation lever. According to real estate professionals, exterior appearance can influence buyer interest and even impact initial pricing discussions by 5–7%, especially in competitive urban and industrial markets. A modern, seamless flat roofing system, reflective coatings, or standing seam metal installation enhances architectural coherence and supports branding efforts—particularly for buildings with high-visibility frontage.

Beyond visual impression, a new roof suggests reduced future risk. Buyers and tenants read a well-installed roof as a sign of fewer upcoming capital expenses. That reduces perceived liability—translating to more confident offers, faster lease-up rates, and stronger long-term occupancy.

In commercial real estate, first impressions aren’t cosmetic—they’re capital.

Improved Appraisal Value

While curb appeal may influence perception, appraisal value is where perception meets numbers. For commercial buildings, appraisers evaluate not just the condition of a property, but its income-producing potential, capital improvements, and market comparables. A new roof directly supports all three.

From an appraisal perspective, the roof is a critical structural component. If it’s nearing the end of its service life or showing signs of damage, appraisers may apply depreciation adjustments, reducing the building’s assessed value. In contrast, a documented roof replacement—especially one using energy-efficient or extended-warranty systems—can qualify as a value-add improvement, potentially boosting the overall valuation by thousands to hundreds of thousands of dollars depending on building size and use.

The impact is especially pronounced for buildings evaluated under the income capitalization approach, where appraisers consider net operating income (NOI) and capitalization rates (cap rates). A new roof can support higher rental income through tenant appeal and reduce operating costs (fewer emergency repairs, lower energy bills), both of which drive NOI upward—resulting in a compounded valuation increase.

For owners preparing to sell, refinance, or revalue, the message is clear: a roof isn’t just overhead—it’s an appraisal asset.

Tax Advantages & Capital Improvements

Replacing a commercial roof isn’t just a maintenance move—it’s a strategic capital improvement that can yield long-term tax benefits. Under U.S. tax law, capital improvements are investments that add value to a property or extend its useful life. A new roof typically qualifies, offering multiple paths to depreciation deductions and tax planning opportunities.

Traditionally, commercial roofs fall under the 39-year straight-line depreciation schedule. However, the Tax Cuts and Jobs Act (TCJA) and later updates have made it possible in some cases to accelerate depreciation through Section 179 or bonus depreciation—especially for specific roofing upgrades that qualify as part of building energy efficiency or renovation packages. These provisions can allow businesses to deduct a large portion (or even all) of the roof cost in the same year it’s installed, depending on eligibility and tax strategy.

In addition, certain roof coatings and materials may qualify for energy-efficiency tax credits, particularly those meeting ENERGY STAR® or cool roof standards in hot climates like Arizona. This creates a layered return: you lower utility bills and reduce your effective tax burden.

The bottom line: when structured correctly, a roof replacement can become a powerful financial tool, not just a sunk cost.

Insurance Benefits & Lower Risk Profile

Insurance providers view your commercial roof as one of the most important structural elements affecting risk. An aging or deteriorating roof increases the likelihood of claims due to leaks, water intrusion, or storm damage, which makes underwriters cautious—and premiums higher. By contrast, a new roof equipped with modern materials and proper installation signals reduced risk exposure, and that can result in real financial savings.

For example, a new roof with impact-resistant materials may qualify for premium discounts, particularly in regions prone to hail or high winds. Similarly, roofs rated for fire resistance or reflective performance can influence eligibility for specialized coverage types or lower deductibles. Some insurers even mandate full roof replacement as a precondition for issuing certain commercial property policies.

A professionally installed roof also reduces the risk of coverage denial. In the event of a claim, insurers will scrutinize maintenance records and condition reports. A new roofing system—especially one with documented inspections, warranty coverage, and code compliance—strengthens your position and increases the likelihood of a successful payout.

Put simply, investing in a new commercial roof isn’t just about avoiding damage—it’s about improving your financial and insurable profile, which can lower long-term costs and strengthen your property’s risk management strategy.

Energy Efficiency & Operating Cost Savings

One of the most underappreciated benefits of a new commercial roof is its impact on energy efficiency—and by extension, operating expenses. Older roofing systems often lack modern insulation standards, reflective coatings, or proper sealing, which can lead to significant heating and cooling losses. Over time, this inefficiency translates into higher energy bills and increased strain on HVAC systems.

New roofing materials—particularly TPO, PVC, and coated metal systems—are engineered for thermal performance. Reflective membranes can reduce heat absorption by as much as 60% in hot climates, which is especially relevant in sun-intense regions like Arizona and the Southwest. This reduction in solar gain directly lowers cooling demand during peak seasons, leading to substantial cost savings over the roof’s lifespan.

In many cases, property owners who upgrade to energy-efficient roofing see measurable utility reductions within the first year. These savings compound over time, offering a return on investment that extends beyond structural benefits.

Additionally, installing high-efficiency roofing can support building certifications such as ENERGY STAR, LEED, or Green Globes, enhancing your property’s attractiveness to sustainability-conscious tenants or investors.

Upgrading your roof isn’t just a capital improvement—it’s an operational upgrade with lasting economic and environmental returns.

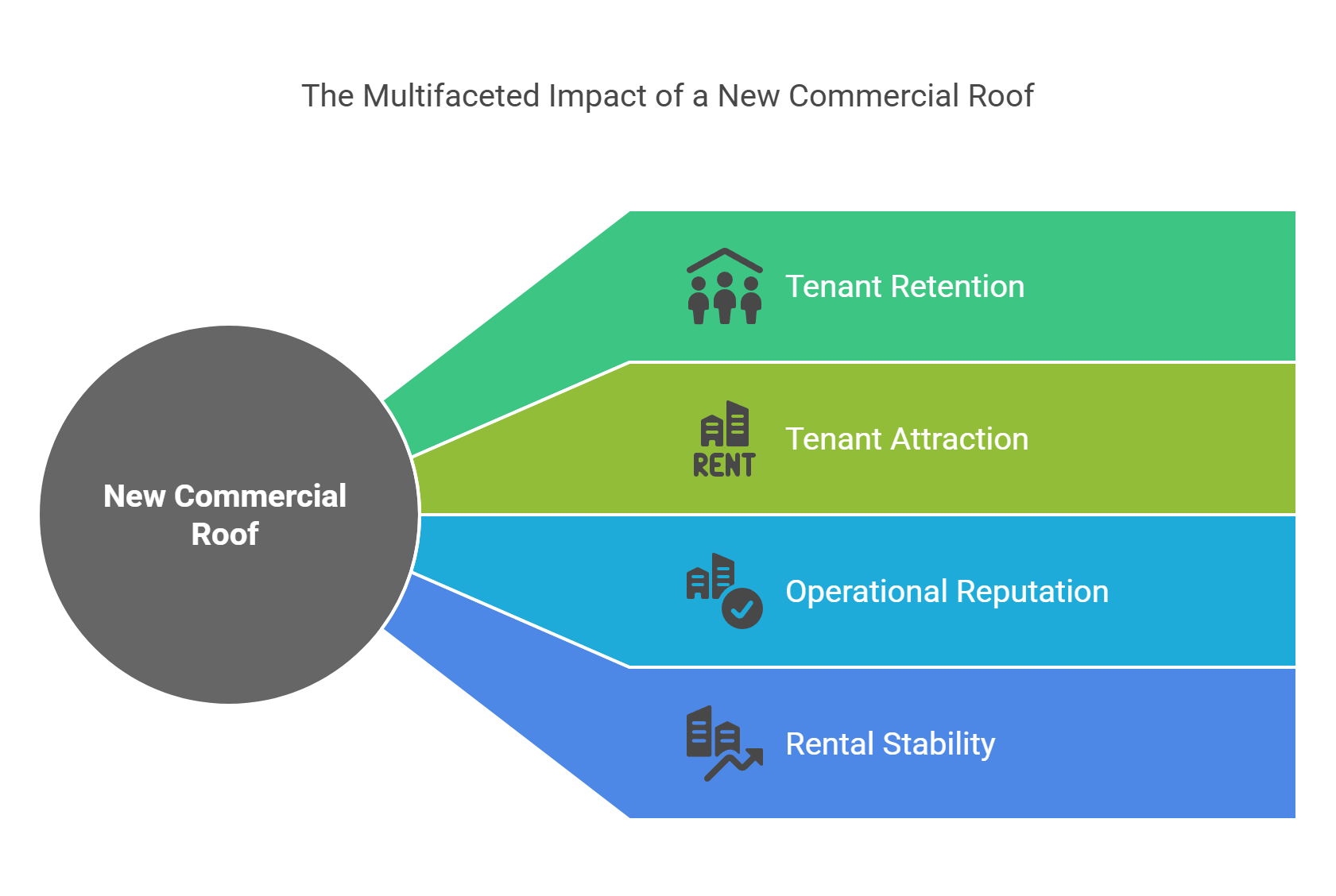

Tenant Satisfaction & Retention

For property owners and managers, retaining quality tenants is as important as attracting them. A new commercial roof can play a surprisingly influential role in both. While tenants may not ask about the roof during a lease signing, they will notice its impact—especially when things go wrong.

Leaks, drafts, poor insulation, or temperature inconsistencies often lead to service calls, operational interruptions, and dissatisfaction. These problems are more than nuisances; they’re deal-breakers in long-term lease decisions. When tenants experience repeated maintenance issues tied to an aging roof, they’re more likely to seek better-managed alternatives once their lease ends.

Conversely, a new, well-performing roof reduces disruption and improves comfort across office, retail, industrial, or medical spaces. Temperature stability, reduced noise during storms, and the absence of water intrusion all contribute to a more professional, reliable environment. This leads to longer lease durations, fewer tenant complaints, and stronger renewal rates.

More importantly, high-performing tenants—those with national brands or essential services—often weigh facility condition when choosing locations. A new roof can be the deciding factor that tips a prospect from interest to commitment.

By reducing service issues and enhancing comfort, a roof upgrade strengthens the building’s operational reputation, leading to higher occupancy and increased rental stability.

Compliance, Code, and Warranty Value

In commercial real estate, regulatory compliance isn’t optional—it’s foundational. Roofing systems are governed by evolving local, state, and national building codes that address everything from drainage and fire resistance to wind uplift standards and energy performance. When a roof nears the end of its lifespan, it often no longer meets current code requirements, even if it was compliant when originally installed.

Replacing an outdated roof brings your building back into alignment with current codes and safety standards. This matters not only for legal liability, but also during appraisals, insurance assessments, and resale. A compliant roof reduces risk of future citations, penalties, or forced repairs, which can deter buyers or complicate refinancing.

New roofs also offer access to modern warranty programs—often including 10-, 20-, or 30-year non-prorated coverage. These warranties can be transferable, which adds value during a property sale. Buyers view transferable warranties as a built-in risk buffer, reducing the likelihood of unexpected capital expenses in the near term.

For owners seeking to position their property as low-risk and professionally maintained, a new roof with documented compliance and warranty protections becomes a powerful asset—not just structurally, but strategically.

Resale & Cap Rate Optimization

When it comes time to sell a commercial property, buyers look beyond the balance sheet—they assess the risk, reliability, and revenue potential of every major building system. Roofing plays a central role in this evaluation. A new roof not only reduces the buyer’s perception of risk but also directly affects one of the most important financial metrics in commercial real estate: the capitalization rate, or cap rate.

The cap rate is calculated by dividing a property’s net operating income (NOI) by its market value. If a new roof reduces maintenance costs, boosts energy efficiency, and helps retain tenants, the resulting increase in NOI pushes valuation upward. At the same time, a roof with modern materials, transferable warranties, and up-to-date compliance reduces perceived future risk. This reduction in perceived risk can lower the buyer’s target cap rate—further increasing the building’s market value.

For example, if a building with $100,000 in NOI is purchased at a 7% cap rate, its value is $1.43 million. But if reduced risk justifies a 6% cap rate, the same building may be worth over $1.66 million—a $230,000 swing, often influenced by capital upgrades like roofing.

In short, a well-executed roof replacement is not just a repair—it’s a tool to optimize the terms of sale, enhance negotiating power, and extract maximum value from the transaction.

ROI Case Studies from California, Arizona, and Nevada

While the benefits of a new commercial roof are well established, the most compelling evidence comes from local case studies—examples where real building owners saw measurable returns from roofing upgrades. In high-solar-gain states like California, Arizona, and Nevada, these returns are often magnified due to extreme heat, high utility costs, and strict building codes.

Case Study 1: Office Complex in Phoenix, AZ

A 30,000-square-foot Class B office property in Phoenix replaced its aging modified bitumen roof with a reflective TPO membrane and upgraded insulation to meet current energy code requirements. Results within 18 months:

- Electricity costs dropped by 21% due to reduced HVAC demand

- The property’s Energy Star score improved by 14 points

- Lease renewal rates rose among medical and professional tenants

- Building valuation increased by an estimated $315,000 based on improved net operating income

Case Study 2: Retail Center in Sacramento, CA

This multi-tenant retail center replaced its built-up roof (BUR) system with a cool roof membrane to comply with California’s Title 24 energy code. Although the initial investment was $220,000, results over the next 24 months included:

- Over $9,000 annually in energy savings

- A 17% reduction in insurance premiums after risk reassessment

- Increased tenant satisfaction, with two national tenants extending their leases

- The property sold 14 months later at a 6.1% cap rate—nearly a full point below comparable properties without roof upgrades

Case Study 3: Light Industrial Facility in Henderson, NV

A 40,000-square-foot warehouse near Las Vegas installed a white PVC roofing system with enhanced insulation and a 20-year manufacturer’s warranty. The owner was preparing for resale:

- The new roof eliminated prior code compliance issues tied to drainage and insulation

- Buyers cited the transferable warranty as a risk-reduction incentive

- The final sale price came in $400,000 above original broker estimates, directly attributed to reduced capital expenditure risk

These examples demonstrate that in sunbelt markets, roof upgrades are more than structural—they’re strategic. When combined with local utility rebates, compliance benefits, and energy cost avoidance, roofing improvements often deliver faster, more predictable ROI than many interior renovations.

Contact A Professional Roofer To Boost Your Property Value

A commercial roof is more than a shield against the elements—it’s a strategic asset that influences property value, operational costs, and investment outcomes. As this article has shown, upgrading your roof can enhance curb appeal, improve appraised value, reduce insurance risk, and deliver measurable energy savings. It can also increase tenant satisfaction, ensure code compliance, and directly impact resale price through cap rate optimization.

These benefits are especially pronounced in regions like California, Arizona, and Nevada, where climate stress, strict energy codes, and rising utility costs put additional pressure on building systems. In these environments, a new roof isn’t just maintenance—it’s a competitive advantage.

Whether you’re looking to attract higher-quality tenants, improve your property’s performance metrics, or prepare for sale, investing in your roof is one of the most reliable ways to increase the return on your commercial real estate.

Ready to understand the real value your roof could unlock?

Contact SW Commercial Roofing today for a no-pressure inspection and customized ROI analysis. We’ll help you turn a structural upgrade into a financial strategy.