Southwest Roof Risks Exposed: Dominate Warranties & Insurance for Max Protection

Imagine this: It’s mid-July in Phoenix, and a sudden monsoon storm unleashes a torrent of rain and hail on your commercial warehouse. Water seeps through a hidden seam in the roof, flooding inventory and halting operations for days. The repair bill? A staggering $75,000—far more than you budgeted for after that recent roof upgrade you thought would pay off big. Sound familiar? As we explored in our previous post, The ROI of a New Commercial Roof, investing in quality commercial roofing can deliver impressive returns through energy savings and enhanced property appeal. But without proper safeguards, those gains can vanish in a flash.

In the Southwest—where extreme heat bakes materials daily, relentless UV rays degrade coatings, seasonal monsoons pound from Arizona to New Mexico, and wildfires threaten California’s edges—navigating commercial roof warranties and insurance isn’t optional; it’s your frontline defense. These tools protect against the region’s unforgiving elements, ensuring your investment withstands the test of time. Yet, many property owners overlook the fine print, leading to denied claims, skyrocketing out-of-pocket costs, and a hit to overall property value. A poorly handled warranty dispute or insurance lapse can erode up to 10-15% of your asset’s worth, turning a smart financial move into a costly headache.

That’s where this guide comes in. We’ll equip you with practical tips to decode complex warranty language, streamline insurance claims for faster resolutions, and implement strategies tailored to Southwest challenges—all while safeguarding your bottom line. From breaking down warranty types and pitfalls to exploring insurance overlaps and regional risks, plus actionable steps like maintenance checklists and claim-filing best practices, you’ll walk away empowered to protect your commercial roof investment like a pro.

Understanding Commercial Roof Warranties: What They Cover and Common Pitfalls

When it comes to commercial roof warranties in the Southwest, knowledge is your best shield against the elements. These legal agreements promise protection for your investment, but they vary widely in scope and strength. Understanding what they cover—and what they don’t—can prevent costly surprises, especially in a region where intense sunlight and temperature swings can accelerate roof degradation by up to 20-30% faster than in milder climates. Let’s break it down step by step.

Types of Warranties in Commercial Roofing

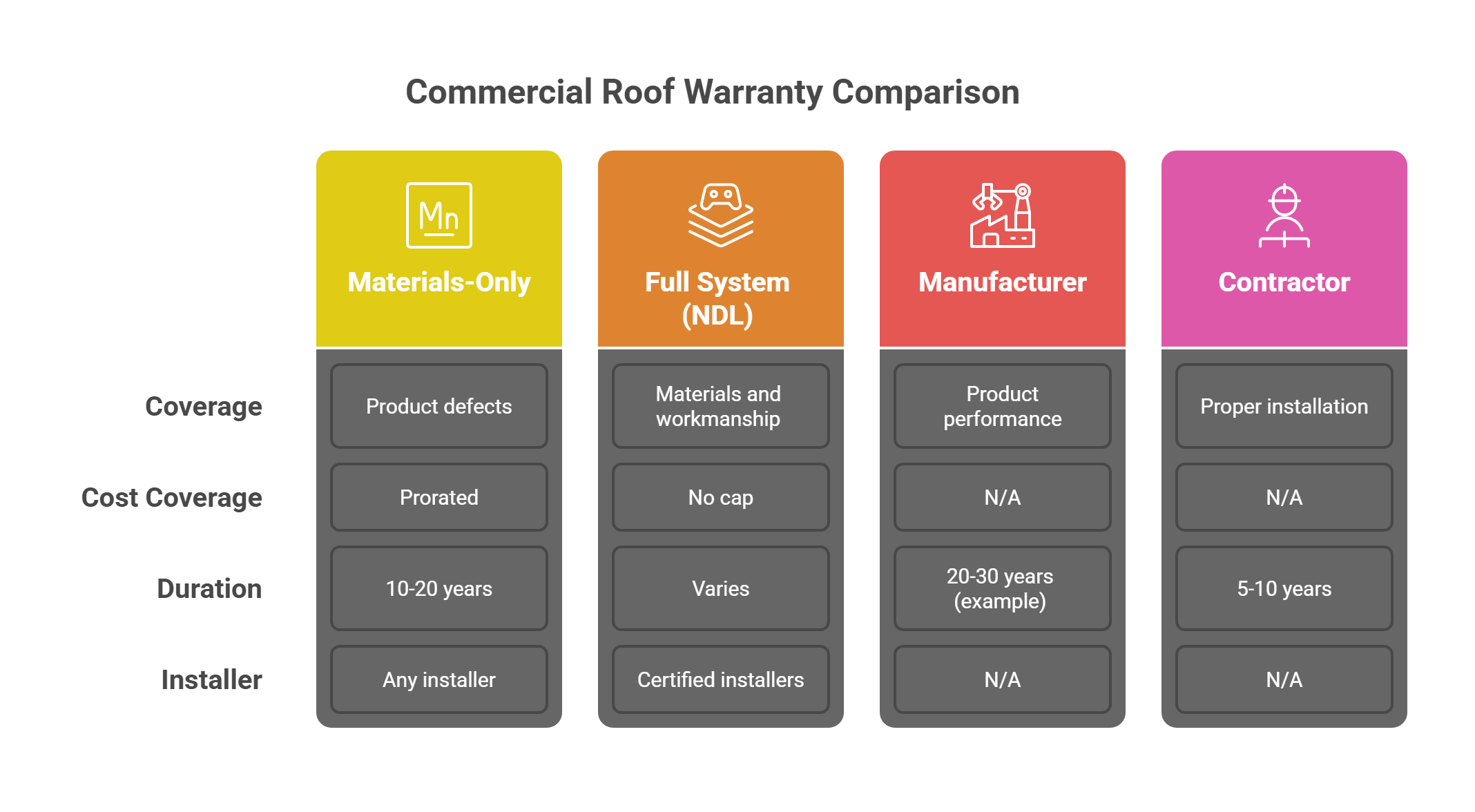

Commercial roof warranties generally fall into two broad categories: materials-only and full system (also known as No Dollar Limit or NDL warranties). A materials-only warranty is the most basic, covering defects in the roofing products themselves—think manufacturing flaws in TPO membranes that cause premature cracking—but it won’t touch labor costs for fixes. These often last 10-20 years and are prorated, meaning your payout decreases over time.

On the flip side, full system warranties provide comprehensive coverage, including both materials and workmanship from installation to repairs, with no cap on costs. They’re ideal for high-value properties but require certified installers. Warranties also split by issuer: manufacturer warranties focus on product performance (e.g., 20-30 years for EPDM’s leak resistance, as detailed in GAF’s single-ply warranty guidelines.), while contractor warranties guarantee proper installation for 5-10 years. In the Southwest, opt for systems like spray polyurethane foam (SPF) or metal roofing, which hold up better against UV rays and heat—metal warranties can extend to 40 years with reflective coatings to combat thermal expansion. However, the region’s brutal summers can shorten effective coverage by hastening material fatigue, so always factor in local conditions when choosing.

Key Terms to Know

Wading through warranty documents feels like decoding legalese, but mastering a few key terms can save you headaches. Here’s a quick glossary:

- Prorated Coverage: Payouts decrease proportionally over the warranty period—e.g., in year 15 of a 20-year policy, you might only get 25% of repair costs.

- Transferability: Whether the warranty passes to a new owner upon property sale; most manufacturer ones do, but confirm in writing to avoid resale snags.

- Exclusions: Clauses that void coverage, like neglect (skipping annual checks) or improper maintenance, which is a top claim denier.

- Weathertightness Guarantee: Assures the roof won’t leak under normal weather—crucial for Southwest monsoons.

- Thermal Performance Warranty: Covers energy efficiency drops, like a TPO roof losing reflectivity in scorching Arizona heat.

Armed with these, you’ll spot red flags faster.

Pitfalls to Avoid

Even the best warranties falter if mishandled. A common trap? Overlooking maintenance mandates—many policies require bi-annual inspections, and skipping them voids everything. In the Southwest, where heat-induced cracks from thermal shock are rampant, undocumented upkeep can turn a simple fix into a full denial.

Take this real-world cautionary tale: A Las Vegas distribution center installed a premium PVC system with a 25-year full warranty. But when hail struck two years in, the claim was rejected—why? No records of the required heat-stress inspections to monitor UV degradation. The owner footed a $40,000 bill, erasing years of ROI gains. To sidestep this, schedule routine checks with pros like us—learn more about our Roof Maintenance services.

The Role of Insurance in Commercial Roof Protection

While warranties provide a safety net for your roof’s inherent quality, insurance steps in to cover the unpredictable punches from Mother Nature—essential in the Southwest where commercial roof insurance can mean the difference between a quick recovery and a business-shuttering disaster. Think of it as the dynamic duo: warranties guard against “what if it fails on its own,” while insurance tackles “what if the world hits it hard.” For Southwest property owners, where hail storms in Phoenix or wildfires near Tucson can rack up claims in the tens of thousands, layering these protections isn’t just smart—it’s a necessity to maintain that ROI we discussed earlier.

Essential Coverage Types

At its core, commercial roof insurance revolves around property coverage for named perils like wind, hail, fire, and vandalism, which directly safeguard your building’s envelope against Southwest staples such as dust devils or sudden downpours. This is often bundled into a broader commercial property policy, reimbursing repair or replacement costs minus your deductible. For ongoing projects, inland marine insurance fills the gap, protecting materials and equipment in transit or on-site during repairs—vital if you’re midway through a TPO overlay in Las Vegas.

Don’t overlook builder’s risk insurance, a short-term policy that covers new installations or full replacements from theft, weather, or accidents until the project wraps. In high-stakes commercial builds, this can prevent delays that cost thousands in lost revenue. Pro tip: Review your policy’s wind/hail deductibles—they can hit 1-5% of the building’s value in storm-prone areas.

Southwest-Specific Insurance Considerations

The Southwest’s volatile climate amps up the stakes, driving premiums 20-30% higher than national averages due to escalating extreme weather events like monsoons and heatwaves. In wildfire hotspots like Tucson, expect elevated rates for fire coverage according to, while San Diego’s coastal winds might trigger surcharges for windstorm riders. Heat-related damage, such as membrane blistering from 110°F+ temps, often requires add-on endorsements for thermal stress, and monsoon flooding in Arizona demands separate flood riders since standard policies exclude it.

Aging roofs exacerbate this—insurers may hike premiums or cap coverage for properties over 15 years old, pushing proactive replacements. For tailored advice, check our article on commercial roofing costs to benchmark your rates.

Overlaps and Gaps Between Warranties and Insurance

Warranties and insurance complement each other but aren’t interchangeable: warranties address manufacturer defects or faulty installation (e.g., a leaking seam from poor workmanship), while insurance handles external perils like hail or vandalism. The overlap? Both can fund repairs, but gaps emerge in deductibles—warranties often have none for covered defects, unlike insurance’s out-of-pocket hits—or exclusions, where insurance skips wear-and-tear that a warranty might catch if maintenance is proven.

Here’s a quick comparison to clarify:

| Aspect | Warranty Coverage | Insurance Coverage |

|---|---|---|

| Scope | Defects in materials/workmanship; prorated over time | Perils like wind, hail, fire; full replacement if total loss |

| Deductibles | Typically none for valid claims | 1-5% of building value; higher in high-risk zones |

| Claim Process | Direct with manufacturer/contractor; requires documentation | File with insurer; adjuster inspection; 30-60 day payout |

At-a-glance: How warranties and insurance stack up for Southwest properties—use this to audit your protections.

By bridging these, you create ironclad defense for your roof.

Southwest Challenges and How to Overcome Them

The Southwest’s diverse and extreme environment turns commercial roofs into battlegrounds, where warranties and insurance must be battle-tested to hold up. From scorching deserts to sudden tempests, these conditions demand more than standard protections—they require region-tuned strategies to prevent erosion of your investment’s value.

Unique Regional Risks

No other U.S. region tests roofing like the Southwest, with its cocktail of arid heat, erratic storms, and geological quirks accelerating wear at rates up to twice the national average. Extreme temperatures—often exceeding 110°F in summer—cause materials to expand during the day and contract at night, leading to cracks, seam failures, and reduced lifespan in systems like single-ply membranes. Add relentless UV radiation, which degrades protective coatings on TPO or EPDM roofs, and you’ve got a recipe for premature aging.

Dust storms, a hallmark of Arizona and New Mexico, act like airborne sandblasters, eroding shingles, sealants, and edges while lifting and tearing vulnerable spots. Monsoons bring flash floods and hail that can puncture low-slope roofs, while wildfires in Southern California threaten ember ignition on combustible materials. Here’s a rundown of the top 5 threats:

- UV Degradation in Phoenix: Intense solar exposure fades and brittles membranes, slashing efficiency by 20% over a decade.

- Thermal Expansion/Contraction: Daily swings stress seams, common in Las Vegas warehouses.

- Dust Storm Erosion: Abrasive particles scour surfaces, accelerating leaks in Tucson.

- Monsoon Hail and Flooding: Sudden storms in Arizona dent and waterlog roofs.

- Seismic and Wildfire Activity in LA: Earthquakes shift structures, while fires ignite dry vegetation nearby.

Ignoring these can void warranties faster than you can say “claim denied.”

Proactive Strategies

Beating these odds starts with tailored prevention. Annual inspections, customized to local building codes, are non-negotiable—especially in California, where Title 24 mandates cool roofs with minimum solar reflectance indices (SRI) of 78 for low-slope commercial roofs to curb heat gain and energy use. This standard requires materials to reflect sunlight and emit absorbed heat efficiently, directly tying into warranty thermal performance clauses. For Arizona monsoons, incorporate hail-resistant upgrades like impact-rated TPO.

Documentation is your claim’s backbone: Maintain photo logs of pre- and post-storm conditions, plus detailed maintenance records, to prove compliance and trigger faster payouts. Tools like drone surveys can spot UV wear early, linking back to our Roof Inspections services for seamless integration.

Real-World Example

Consider a Tucson retail center hammered by a 2023 hailstorm—mirroring cases where older flat roofs suffered hidden punctures, leading to leaks and $60,000 in initial damages. The owner, armed with a full-system warranty and comprehensive insurance, coordinated an inspector’s report showing compliant maintenance under Title 24-equivalent standards. This unlocked a prorated warranty repair for membrane defects and an insurance payout covering hail impacts, slashing out-of-pocket costs from $60K to $15K. Post-fix, energy bills dropped 18% thanks to a cool roof overlay, boosting ROI by preserving property value amid resale talks. Lesson? Proactive docs turn disasters into dividends.

Actionable Tips to Protect Your Roof Investment

You’ve got the knowledge on warranties, insurance, and Southwest-specific hurdles—now let’s turn it into action. These 8 practical tips will help you fortify your commercial roof against the unexpected, minimizing downtime and maximizing that ROI boost from our earlier discussion (like preserving a 15% property value uplift by averting a single $50K claim). Implement them step-by-step to decode policies, streamline claims, and build resilience tailored to desert demands.

- Review Warranties Annually with a Certified Inspector: Dust off those documents every 12 months to check for prorated shifts or exclusions. Pair this with a pro inspection to document compliance—skipping it voids 40% of claims in high-heat zones. Schedule your free roof inspection today to stay ahead.

- Bundle Policies for Multi-Site Properties: If you manage roofs across Phoenix, San Diego, or beyond, consolidate under one carrier for 10-20% premium discounts and unified claims handling. This simplifies wildfire or monsoon filings across states.

- Leverage Digital Tools for Claim Tracking: Apps like RoofScope or insurer portals let you upload geo-tagged photos of damage in real-time, speeding approvals by up to 50%. For UV wear, timestamp images to prove early detection.

- Partner with Southwest-Experienced Contractors: Choose locals versed in Title 24 cool roof standards or Arizona monsoon retrofits—they handle warranty transfers and insurance adjuster liaisons seamlessly, cutting resolution time from months to weeks.

- Budget for Deductibles and Explore State Rebates: Set aside 1-3% of property value for wind/hail hits, then tap incentives like California’s SGIP for energy-efficient upgrades or Arizona’s solar tax credits on reflective TPO systems via the Arizona Department of Revenue’s solar credit form —potentially offsetting 30% of costs.

- Document Everything Religiously: Create a digital log of maintenance (e.g., quarterly cleanings) and pre-storm baselines. This evidence turns “he said, she said” denials into approved payouts, especially for thermal claims in Las Vegas summers.

- Add Riders for Emerging Risks: Bolster base policies with endorsements for hail impact or wildfire embers—crucial as Southwest events rise 15% yearly. Review annually as climate patterns shift.

- Simulate Claims with a Drill: Run a mock filing quarterly to test your process, uncovering gaps like missing transferability clauses before a real Tucson hail event strikes.

Tie these back to your bottom line: Proactive steps like these can slash claim costs by 25-35%, directly feeding into energy savings and resale premiums. For a head start, download our free “Southwest Roof Protection Checklist” below—it’s packed with templates for logs, review schedules, and rebate trackers.

Final Thoughts

Mastering commercial roof warranties and insurance isn’t just about paperwork—it’s about transforming Southwest vulnerabilities into unbreakable strengths. In a region where monsoons, wildfires, and blistering heat can strike without warning, these protections turn potential disasters into manageable hurdles, preserving your property’s value and unlocking sustained ROI. By decoding warranty fine print, layering smart insurance riders, tackling regional risks head-on, and following our actionable tips, you’re not just safeguarding your roof—you’re future-proofing your business against the unpredictable.

Looking ahead, stay tuned for our next post on tech innovations like AI-driven claim processing and drone surveillance, which could revolutionize how you monitor and maintain Southwest roofs.

Ready to fortify your investment? Don’t wait for the next storm—schedule a free warranty and insurance review with our experts today. We’ll audit your coverage, spot gaps, and provide tailored recommendations to keep your commercial property resilient. Get Your Free Warranty Review Today – click now and take the first step toward peace of mind.

Related Posts:

The ROI of a New Commercial Roof: How It Increases Property Value, Lowers Costs, and Boosts Resale